🔥 Today’s Top Gainer Analysis (IT): View Full Analysis →

📋 Table of Contents

Market Overview

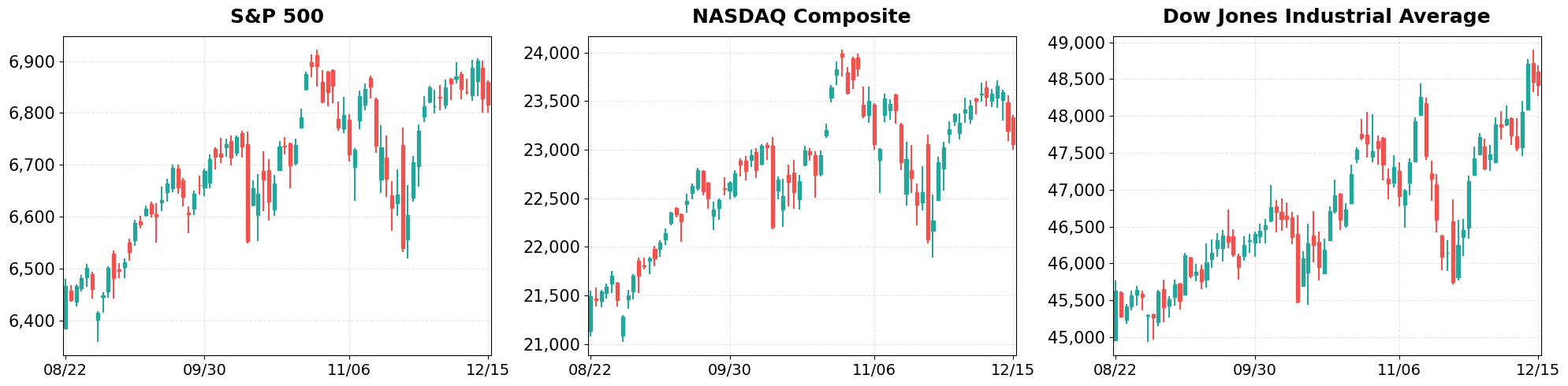

On Monday, December 15, 2025, U.S. equities slipped across the board as investors digested mixed earnings reports and lingering inflation concerns. The S&P 500 closed at 6,816.51, the Nasdaq Composite at 23,057.41, and the Dow Jones Industrial Average at 48,416.56, each posting modest declines. Breadth was thin, with technology leading the downturn while defensive sectors showed relative resilience.

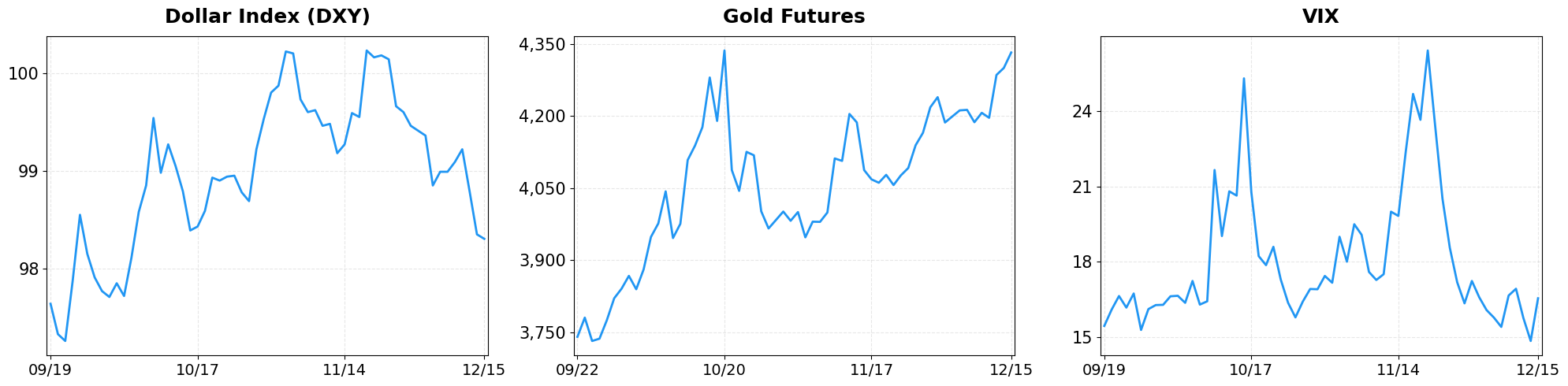

- Dollar Index moved from 98.35 to 98.30 (-0.05%).

- Gold Futures moved from 4300.10 to 4332.20 (+0.75%).

- VIX moved from 14.85 to 16.55 (+11.45%).

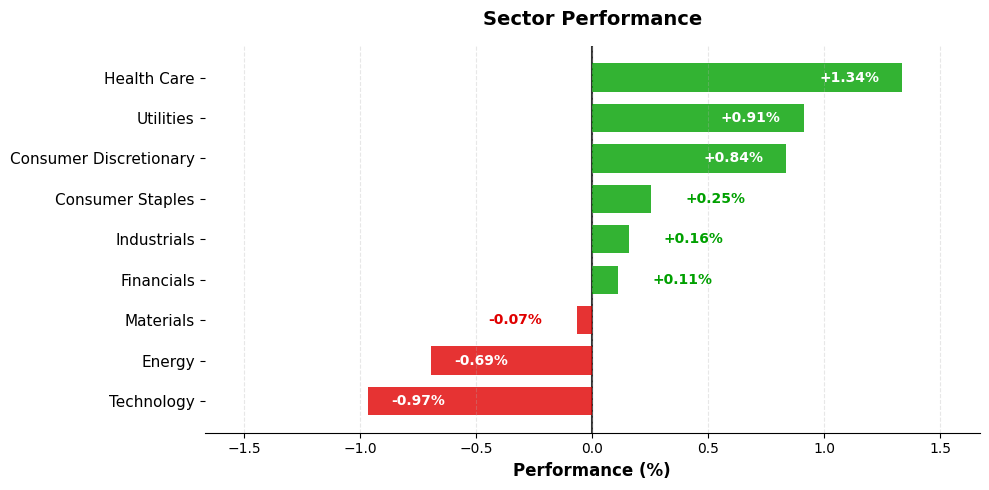

Today’s sector performance shows the following movements:

Market News Highlights

Equity markets opened lower on December 15, 2025, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all slipping as technology stocks retreated ahead of the upcoming jobs report. The tech pullback reflected heightened caution among investors who are awaiting fresh employment data that could shape the Federal Reserve’s rate outlook. The broader indices were pressured by the same sentiment, with the S&P 500 hovering near recent support levels and the Nasdaq showing the steepest decline due to its heavier weighting in growth‑oriented shares.

In the cryptocurrency arena, Bitcoin fell to $86,000, and the broader digital‑asset market followed suit, driven by a “lack of conviction” among traders. The dip signaled that speculative momentum is waning, and investors appear reluctant to push prices higher without clearer macroeconomic cues. The decline in Bitcoin also weighed on related tokens, reinforcing a short‑term bearish bias across the crypto sector.

Meanwhile, the inclusion of former 2022 laggards Carvana, Robinhood, and Coinbase into the S&P 500 this year underscores a broader market rotation toward newer, high‑growth names that have recovered from earlier setbacks. Their addition may provide a modest boost to the index’s performance, but the immediate impact is muted as investors remain focused on the near‑term earnings landscape and the forthcoming employment figures that will influence monetary policy expectations.

Referenced Articles

- Stock market today: Dow, S&P 500, Nasdaq slip as tech slides ahead of jobs report

- Bitcoin drops to $86,000 as ‘lack of conviction’ keeps a lid on crypto prices

- Nov. jobs data, 2026 outlook, YF’s Company of the Year: 3 Things

- Carvana, Robinhood, Coinbase: How 3 of the market’s biggest 2022 losers ended up in the S&P 500 this year

- Top Cryptocurrencies Fall; Bitcoin Drops Below $86,000 Level

Index Performance

S&P 500 (-0.16%)

The benchmark fell 10.90 points, or 0.16%, as earnings pressure mounted in consumer‑discretionary and industrial stocks, offsetting gains from utilities. Trading volume was below average, suggesting limited conviction behind the move.

NASDAQ Composite (-0.59%)

The tech‑heavy Nasdaq dropped 137.76 points, a 0.59% decline, as semiconductor makers reported weaker‑than‑expected sales and investors rotated into safer assets. Growth‑oriented stocks led the sell‑off, dragging the broader market lower.

Dow Jones Industrial Average (-0.09%)

The Dow slipped 41.49 points, down 0.09%, with industrial giants such as Boeing and Caterpillar weighing on the index amid concerns over supply‑chain constraints. Nonetheless, the modest decline reflects the index’s defensive weighting relative to the broader market.

Top Movers

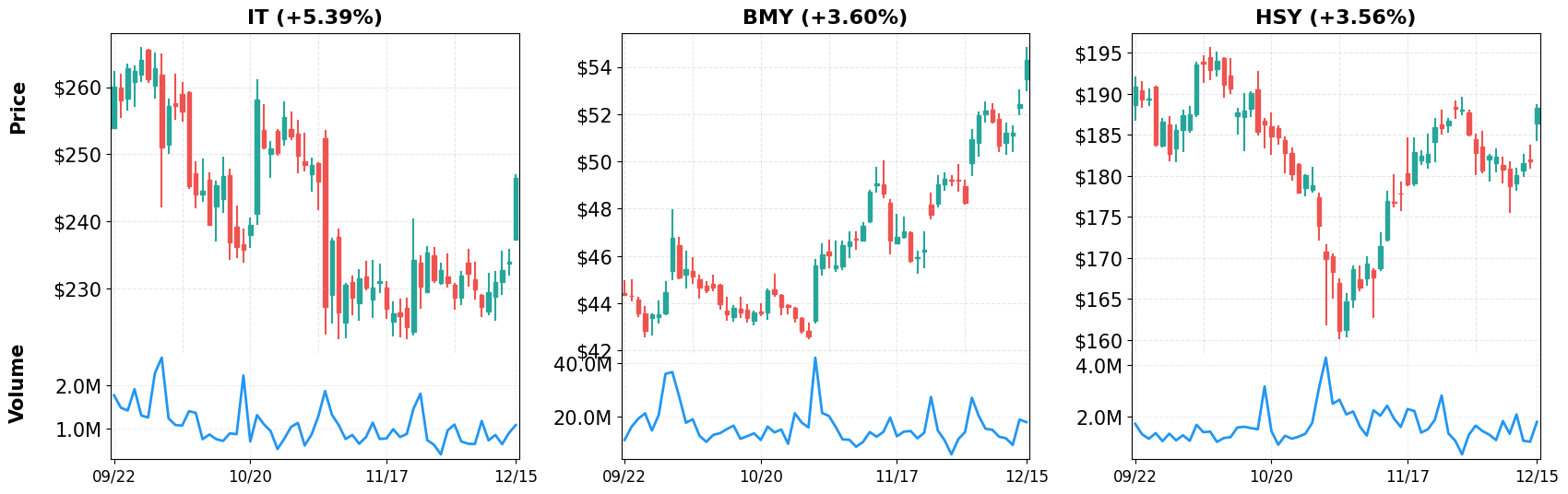

Top Gainers

- IT (+5.39%)

- BMY (+3.60%)

- HSY (+3.56%)

Top Losers

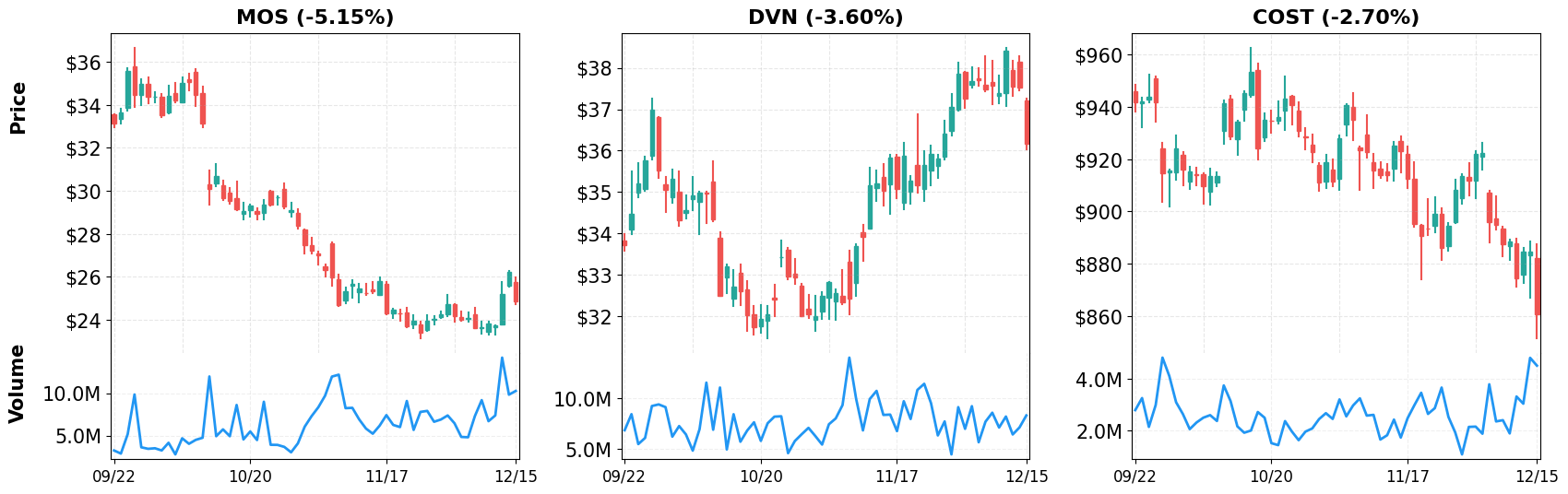

- MOS (-5.15%)

- DVN (-3.60%)

- COST (-2.70%)

Magnificent 7

Overview

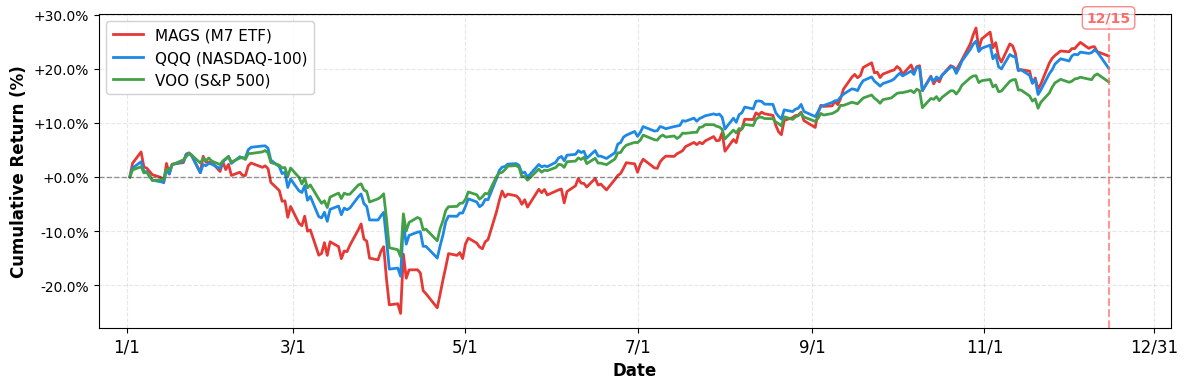

Performance Comparison: Magnificent 7 vs Major Indices

- YTD Performance:

- S&P 500 (VOO): +17.57%

- NASDAQ-100 (QQQ): +20.11%

- Magnificent 7 (MAGS): +22.34%

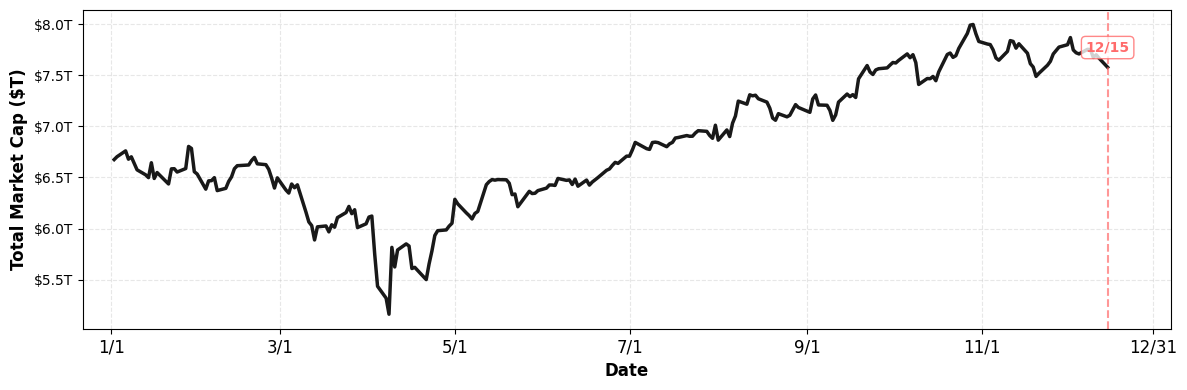

M7 Total Market Capitalization

- YTD Market Cap Change:

- $6.68T (1/1) → $7.58T (current), +13.47%

1. AAPL

Price: $274.11 (-1.50%)

- Dell Technologies vs. Apple: Which PC Stock Has an Edge Now?

- The $50 Trick That Lets You Own Enough Apple Stock to Really Grow Your Money

- 1 Reason I’m Watching Apple Heading Into 2026

2. MSFT

Price: $474.82 (-0.78%)

- OpenAI is the 2025 Yahoo Finance Company of the Year

- Corporate America is scrambling to hire energy traders as the AI boom pressures electricity costs

- Not ‘very hawkish at all’: Wall Street optimistic on stock market rally in 2026 after Fed rate cut

Disclaimer: This market briefing is for informational and educational purposes only and should not be considered investment advice. The information presented is based on publicly available data and represents the author’s analysis as of December 15, 2025. Stock prices are volatile and past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making investment decisions. The author may or may not hold positions in the securities discussed.

Leave a comment