🔥 Today’s Top Gainer Analysis (GEV): View Full Analysis →

📋 Table of Contents

Market Overview

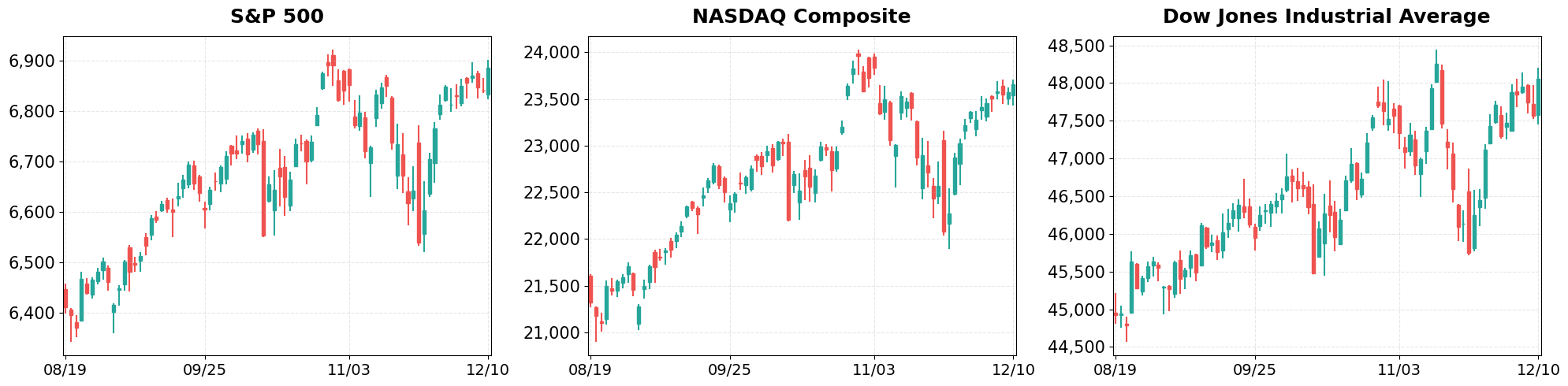

U.S. equities closed higher on December 10, 2025, as broad‑based optimism lifted the major indices. The S&P 500 finished at 6,886.68, up 0.67% (46.17 points), while the Nasdaq Composite rose to 23,654.16, gaining 0.33% (77.67 points). The Dow Jones Industrial Average led the rally, ending at 48,057.75, a 1.05% increase (497.46 points). Sector momentum was driven by strong earnings from technology and consumer discretionary firms, offsetting lingering concerns over inflationary pressures.

- Dollar Index moved from 99.22 to 98.66 (-0.57%).

- Gold Futures moved from 4206.70 to 4260.60 (+1.28%).

- VIX moved from 16.93 to 15.76 (-6.91%).

Today’s sector performance shows the following movements:

Market News Highlights

The equity markets posted a pronounced rally today, with the Dow Jones Industrial Average posting a strong surge and the S&P 500 edging toward fresh record highs. The rally was sparked by the Federal Reserve’s decision to cut rates, a move that immediately eased the cost‑of‑capital outlook for both consumers and corporations. Chairman Powell’s reassurance that no further surprises are expected reinforced investor confidence, driving risk‑off assets lower and bolstering the appetite for growth‑oriented equities.

Corporate earnings mixed the tone of the session. GameStop’s shares slipped sharply after a disappointing earnings beat, while Chewy’s stock oscillated amid volatile guidance. Meanwhile, Oracle’s upcoming results remain a focal point for the technology sector; analysts will be watching for any signs of sustained demand for enterprise cloud services that could sustain the broader market’s upward trajectory. In parallel, commentary on private‑market dynamics highlighted that alternative assets will be pivotal in navigating the “60‑40” equity‑bond headwinds anticipated in 2026, suggesting a potential shift in institutional allocation strategies.

Long‑term thematic considerations also surfaced. A video analysis outlined three upcoming phases of the AI cycle slated for 2026, underscoring the expectation that AI‑driven innovation will continue to fuel valuation premiums in select tech stocks. Conversely, a separate piece explained why former President Trump’s Nvidia–China announcement failed to move markets, indicating that investors view the policy signal as largely neutral given existing supply‑chain adjustments and the broader macro backdrop.

Referenced Articles

- Stock market today: Dow surges, S&P 500 rallies near record as Fed cuts rates, Powell offers no ‘surprises’

- Private markets will be key to overcoming 60-40 headwinds in 2026

- Earnings live: GameStop stock slides, Chewy fluctuates, with Oracle’s closely watched results on deck

- The next 3 phases of the AI cycle to come in 2026

- Why Trump’s Nvidia–China announcement didn’t move markets

Index Performance

S&P 500 (+0.67%)

The 0.67% rise reflects renewed confidence in large‑cap stocks after several companies reported earnings beats. Weighting in health care and industrials added further support, keeping the index firmly above the 6,800 level.

NASDAQ Composite (+0.33%)

The Nasdaq’s 0.33% gain was anchored by continued strength in the semiconductor and cloud‑computing subsectors. Despite a modest advance, the index remains sensitive to valuation metrics, which could temper future upside.

Dow Jones Industrial Average (+1.05%)

The Dow’s 1.05% surge, the largest percentage move among the three benchmarks, was powered by robust performance in industrials and financials. The 497.46‑point jump underscores the market’s appetite for cyclical exposure as the economy shows signs of resilience.

Top Movers

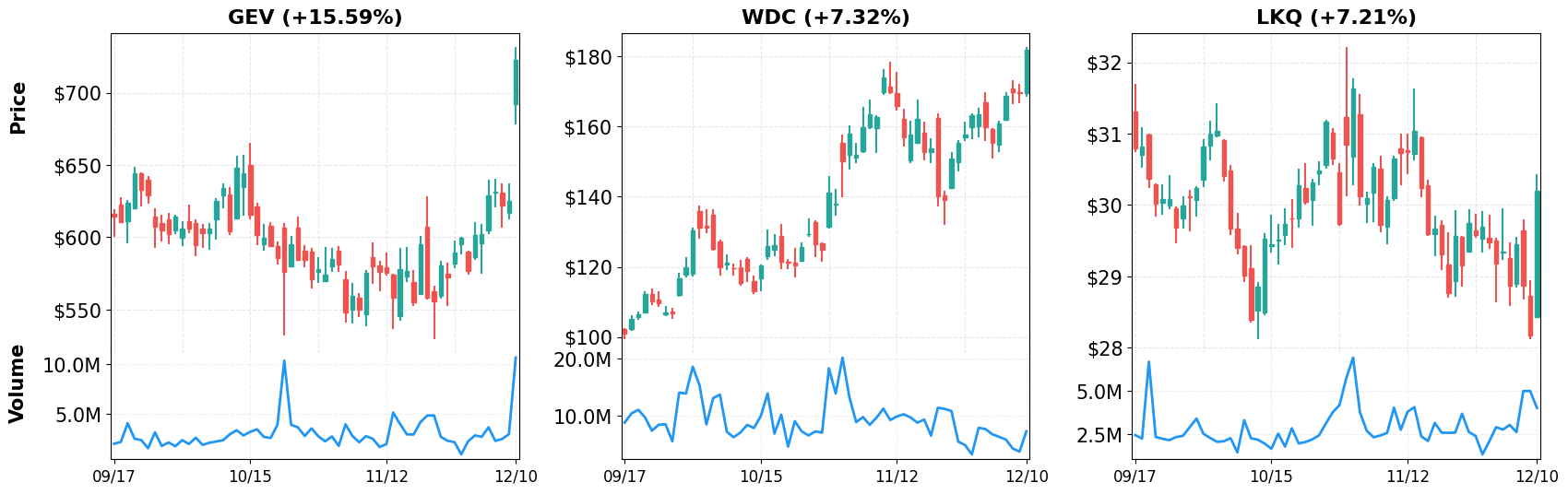

Top Gainers

- GEV (+15.59%)

- WDC (+7.32%)

- LKQ (+7.21%)

Top Losers

- UBER (-5.52%)

- MELI (-5.00%)

- DASH (-4.21%)

Magnificent 7

Overview

Performance Comparison: Magnificent 7 vs Major Indices

- YTD Performance:

- S&P 500 (VOO): +18.74%

- NASDAQ-100 (QQQ): +23.47%

- Magnificent 7 (MAGS): +24.08%

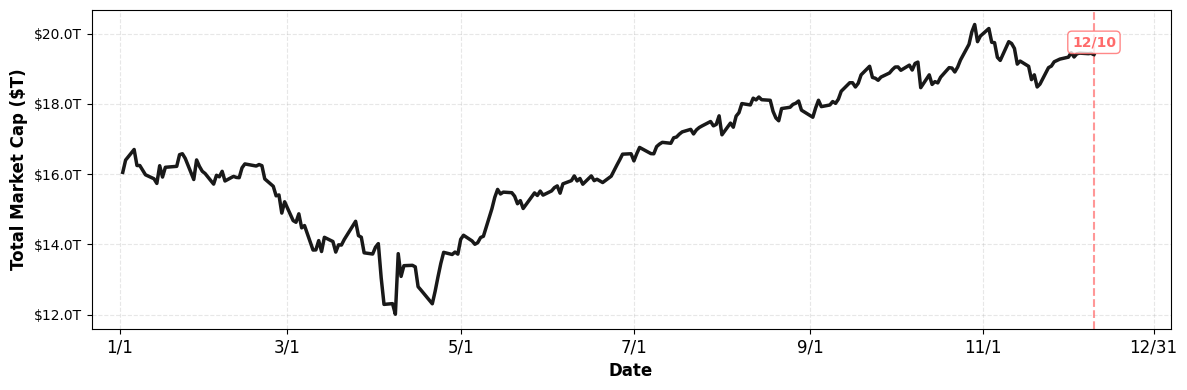

M7 Total Market Capitalization

- YTD Market Cap Change:

- $16.05T (1/1) → $19.40T (current), +20.87%

1. AAPL

Price: $278.78 (+0.58%)

- Apple’s Tim Cook reportedly on Capitol Hill, Oracle earnings watch

- Apple’s Cook Presses Congress Over Child Online Safety Bill

- Apple’s Foldable iPhone Expected to Land Well with Consumers

2. AMZN

Price: $231.78 (+1.69%)

- Amazon solves Walmart, Target, and Kroger’s shoplifting problem

- Amazon Stakes $35B on India’s AI, Logistics and Export Expansion

- Oracle set to report earnings as Wall Street looks for cracks in the AI bubble

3. GOOGL

Price: $320.21 (+0.99%)

- Move Over Lumentum Holdings, Alphabet Is a Better AI Play

- How to claim your share of Google Play refunds

- Oracle set to report earnings as Wall Street looks for cracks in the AI bubble

4. META

Price: $650.13 (-1.04%)

- Will Meta Platforms (META) Stock Hit $1,000 in 2027?

- Could Meta Stock Skyrocket in 2026 If Mark Zuckerberg Declares Another ‘Year of Efficiency’?

- Apollo exec says data center debt wave is ‘tip of the iceberg’

5. MSFT

Price: $478.32 (-2.78%)

- Talk of an AI bubble is just ‘ridiculous,’ this strategist says

- How Big Tech’s AI build-out is ‘mostly’ a private credit story

- Sector Update: Tech Stocks Rise Late Afternoon

6. NVDA

Price: $183.78 (-0.64%)

- Trump says Nvidia can sell H200 chips to China, but nothing is guaranteed

- OpenAI CEO joins Jimmy Fallon following Nvidia CEO’s Joe Rogan chat

- Market Chatter: Alibaba, ByteDance Approach Nvidia for H200 Orders After Trump’s Export Approval

7. TSLA

Price: $451.43 (+1.41%)

- Elon Musk Sets Self-Driving Tesla Robotaxi Countdown To Three Weeks

- Morgan Stanley Downgrades Tesla: Should You Revisit Your EV ETF Portfolio?

- Magnificent Seven Stocks: Nvidia Slides; Tesla Offers New Buy Point

Disclaimer: This market briefing is for informational and educational purposes only and should not be considered investment advice. The information presented is based on publicly available data and represents the author’s analysis as of December 10, 2025. Stock prices are volatile and past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making investment decisions. The author may or may not hold positions in the securities discussed.

Leave a comment