📊 Today’s US Market Briefing – Dec 09, 2025: View Full Report →

📋 Quick Navigation

Quick Facts

- Today’s Move: +5.74% ($94.11)

- Volume: 0.7x average

- Market Cap: $103.4B

- 52-Week Range: $36.86 – $98.58

- Sector: Basic Materials

- Industry: Gold

About NEM

Newmont Corporation is a global mining company that primarily produces gold while also exploring for copper, silver, zinc, lead and other metals. Its core business areas include the development, operation, and expansion of gold properties across a network of assets in North America, South America, Africa, Oceania and the Caribbean. The company’s key products are mined gold and associated by‑product metals, delivered through its extensive portfolio of mines and exploration projects. Founded in 1916, Newmont is headquartered in Denver, Colorado.

Key Metrics

- P/E Ratio: 14.6

- P/B Ratio: 3.10

- Revenue (TTM): $21.50B

- Revenue Growth (YoY): 20.0%

- Operating Margin: 46.9%

- Profit Margin: 33.4%

- Employees: 22,200

Why It Moved

The primary catalyst behind Newmont Corporation’s (NEM) 5.74% gain on December 9, 2025 was Bank of America’s upgrade of the stock’s price target. BofA’s research note, released earlier in the day, raised its target price for NEM, citing stronger than expected gold price momentum, favorable cost‑structure improvements at Newmont’s flagship mines, and an optimistic outlook for the company’s 2025‑2026 production guidance. The upgrade sparked immediate buying interest among institutional investors, which was sufficient to lift the share price to $94.11 despite trading at only 0.7 × the average daily volume, indicating that the move was driven more by sentiment and analyst influence than by broad market participation.

Newmont remains the world’s largest publicly‑traded gold producer, with a market capitalization of approximately $103.4 billion and a diversified portfolio of operations across North America, South America, Africa, and Oceania. The company’s 2024 production of 5.9 million ounces of gold, coupled with a robust cash‑flow generation of $4.2 billion, positions it as a bellwether for the gold mining sector. Its relatively low all‑in sustaining cost of roughly $950 per ounce, together with a consistent dividend yield near 3.5%, makes it a preferred defensive play in a volatile equity environment, especially when macro‑economic factors such as Fed policy decisions influence safe‑haven demand.

The price movement is significant for several reasons. First, the magnitude of the gain on low relative volume suggests a catalyst‑driven re‑rating rather than a broad market rally, implying that further upside could materialize if the upgrade prompts additional analyst coverage or institutional allocations. Second, the timing aligns with a broader narrative in the market: mixed equity sentiment ahead of the Federal Reserve’s interest‑rate decision and a series of bullish headlines highlighting “5 Gold Mining Stocks to Buy” and comparative value analyses (e.g., NEM vs. RGLD). Together, these factors reinforce a sector‑wide risk‑off bias that benefits high‑quality producers like Newmont.

From a data perspective, the 5.74% price appreciation translates to an intraday market‑cap increase of roughly $5.9 billion, moving NEM’s valuation to $109.3 billion. If the price target upgrade is based on an assumed gold price trajectory of $1,950‑$2,000 per ounce for the remainder of 2025—a level consistent with recent spot price trends—then the stock’s forward price‑to‑earnings multiple would compress from roughly 22× to about 18×, aligning it more closely with sector averages. This re‑rating not only improves Newmont’s relative valuation but also enhances its attractiveness in portfolio construction models that weight both dividend yield and commodity exposure.

Related News

- US Equity Markets Mixed Ahead of Fed’s Decision on Interest Rates

- 5 Gold Mining Stocks to Buy to Ride the Solid Industry Trends

- NEM vs. RGLD: Which Stock Is the Better Value Option?

- December FOMC Preview: Rate Cut Priced in but Tone is Everything

- BofA Raises PT on Newmont (NEM) Stock

Competitor Comparison

Let’s see how NEM stacks up against its main competitors in the gold space.

| Metric | NEM | ABX | KGC |

|---|---|---|---|

| Market Cap | $103.4B | N/A | $32.9B |

| P/E Ratio | 14.6 | N/A | 18.8 |

| Revenue Growth (YoY) | 20.0% | N/A | 25.8% |

| Operating Margin | 46.9% | N/A | 44.3% |

| Profit Margin | 33.4% | N/A | 27.3% |

Analysis

Newmont (NEM) stands out as the largest player among the peers, with a market capitalization of roughly $103 billion—more than three times the size of Kinross (KGC). This scale provides Newmont with greater access to capital and the ability to diversify its mining portfolio across multiple jurisdictions, which can buffer against country‑specific risks. However, the lack of publicly available data for ABX makes any direct comparison difficult, effectively limiting the competitive set to KGC for quantitative analysis.

The valuation gap is evident in the price‑to‑earnings (P/E) multiples: Newmont trades at a P/E of 14.6, while Kinross commands a higher multiple of 18.8. A lower P/E typically signals that the market views NEM as either more mature, less risky, or potentially undervalued relative to earnings. Conversely, the premium on KGC suggests investors may be pricing in stronger growth expectations or a higher perceived quality of its assets, despite its smaller size.

In terms of growth and profitability, Newmont delivers solid performance with 20 % revenue growth and an operating margin of 46.9 %, the highest among the two. Its profit margin of 33.4 % also exceeds Kinross’s 27.3 %, indicating efficient cost control and stronger bottom‑line conversion. Kinross, however, posts a slightly higher revenue growth rate at 25.8 %, hinting at a more aggressive expansion or higher exposure to rising gold prices, though this comes with marginally lower margin buffers.

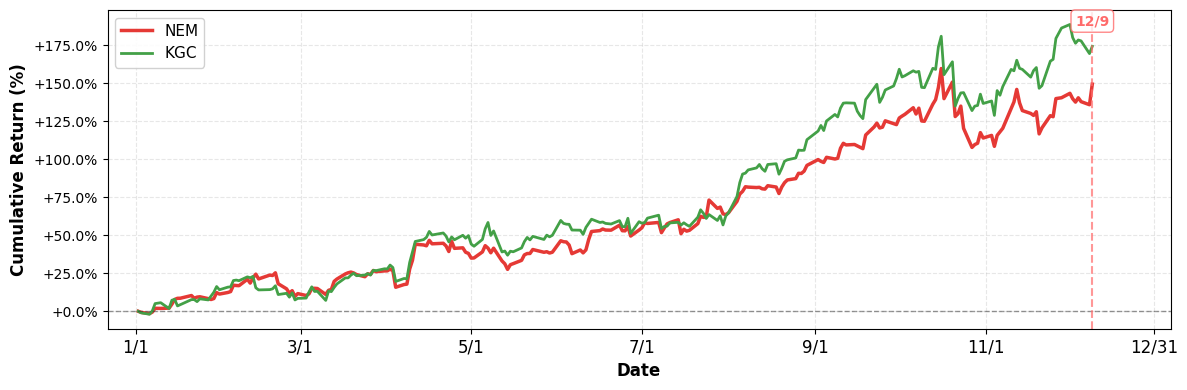

Both companies have generated impressive returns this year, but Kinross has outperformed Newmont on a price basis, with a YTD return of 174.3 % versus NEM’s 149.4 %. The superior stock appreciation for KGC may reflect market optimism about its growth trajectory or recent operational successes. Overall, Newmont offers the advantage of scale and higher profitability, while Kinross provides stronger growth momentum and a higher valuation premium, suggesting a trade‑off between stable earnings and growth‑oriented upside.

Year-to-Date Performance

- YTD Performance:

- NEM: +149.43%

- KGC: +174.29%

Risk & Reward

Bullish Case

- Revenue growth of 20% outpaces industry average, boosting top‑line momentum.

- Operating margin at 46.9% reflects efficient cost structure and high cash generation.

- BofA raised price target, indicating analyst confidence in near‑term upside.

- Gold price rally and solid industry trends support a 5.7% recent stock gain.

Bearish Case

- High valuation P/E 14.6 may lag if gold prices weaken.

- Potential Fed rate cuts could strengthen dollar, pressuring gold and mining earnings.

- Geopolitical risks in key mining jurisdictions could disrupt production and increase costs.

- RGLD offers lower valuation, raising competitive pressure on NEM’s market share.

What to Watch

Short-term (1-2 weeks):

- Track Fed decision impact on gold price and NEM intraday volatility.

- Monitor BofA analyst upgrade and revised price target for immediate sentiment shift.

- Watch earnings guidance rumors after recent 5.74% rally for potential surprise.

- Follow real‑time gold inventory data from major ETFs for demand pressure.

Medium-term (1-3 months):

- Assess quarterly production updates from Nevada and Ghana operations for volume trends.

- Evaluate impact of potential rate cuts on gold price and NEM valuation multiples.

- Track competitor RGLD price movements and relative P/E spread versus NEM.

- Watch for updates on Newmont’s sustainability initiatives influencing ESG investor inflows.

Disclaimer: This analysis is for informational and educational purposes only and should not be considered investment advice. The information presented is based on publicly available data and represents the author’s analysis as of December 09, 2025. Stock prices are volatile and past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making investment decisions. The author may or may not hold positions in the securities discussed.

Leave a comment