🔥 Today’s Top Gainer Analysis (NEM): View Full Analysis →

📋 Table of Contents

Market Overview

On Tuesday, December 09, 2025, U.S. equity markets posted a mixed session, with technology stocks providing modest upside while industrials and broad‑based indices slipped. The S&P 500 edged lower by six points to 6,840.51, reflecting a slight pullback in energy and financials. Meanwhile, the Dow Jones Industrial Average fell 179.03 points to 47,560.29, underscoring continued pressure on large‑cap manufacturers.

- Dollar Index moved from 99.09 to 99.24 (+0.15%).

- Gold Futures moved from 4187.20 to 4241.20 (+1.29%).

- VIX moved from 16.66 to 16.86 (+1.20%).

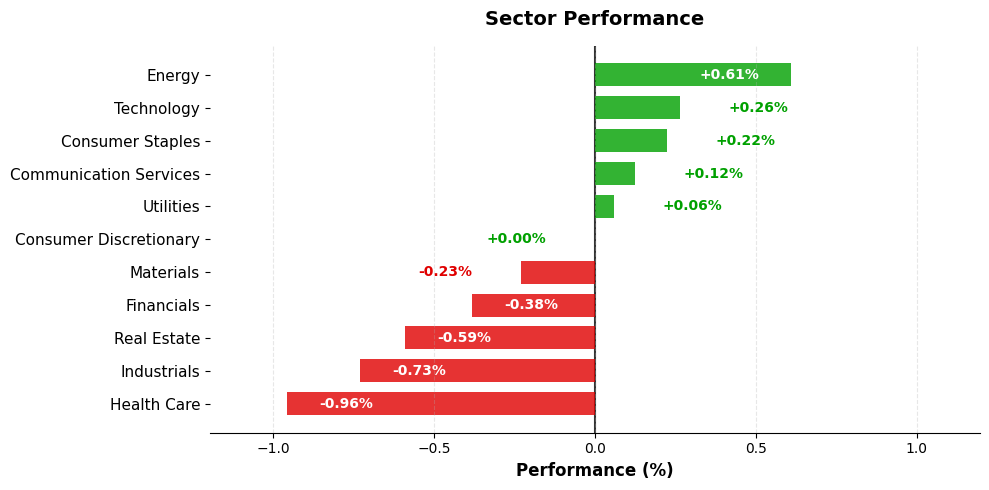

Today’s sector performance shows the following movements:

Market News Highlights

The equity landscape on December 09, 2025 was marked by a cautious tone as investors awaited the Federal Reserve’s policy decision. The Dow Jones Industrial Average slipped modestly, dragged down by a notable decline in JPMorgan Chase shares, while the S&P 500 and Nasdaq Composite remained largely flat. This muted movement reflected a “wait‑and‑see” approach, with market participants balancing the potential impact of monetary policy against earnings momentum in key sectors.

In the index rebalancing arena, Ares Management’s upcoming inclusion in the S&P 500 sparked a brief rally for the broader index but simultaneously triggered a sharp sell‑off in Sallie Mae, whose stock plunged on concerns about its weighting and potential dilution effects. Meanwhile, the technology sector continued its upward streak, buoyed by strong earnings from Nvidia and a bullish “Santa Claus” indicator that historically signals year‑end optimism. Conversely, Netflix experienced a setback after a deal‑related drama, pulling the Nasdaq lower and highlighting the sensitivity of high‑growth stocks to corporate news.

Overall, U.S. equity indexes closed mixed in the final leg of trading. The divergence between defensive financials and high‑growth tech illustrates a market still calibrating risk amid macro‑policy uncertainty. Investors appear poised to react sharply to the Fed’s announcement, with the balance of power likely shifting between rate‑sensitive financials and momentum‑driven technology names.

Referenced Articles

- Stock market today: Dow slips as JPMorgan slides, S&P 500, Nasdaq little changed with all eyes on Fed decision

- Ares to join the S&P 500, Sallie Mae stock plunges

- Tech sector streak, Santa Claus indicator: Market takeaways

- Stock market today: Dow, S&P 500, Nasdaq fall as Netflix skids on deal drama, Nvidia rises

- US Equity Indexes Mixed in Final Leg of Trading

Index Performance

S&P 500 (-0.09%)

The S&P 500 closed at 6,840.51, down 0.09% on the day, as investors digested weaker earnings from several major banks and a modest rise in Treasury yields. Volume was thin, suggesting limited conviction behind the decline.

NASDAQ Composite (+0.13%)

The Nasdaq Composite rose to 23,576.49, up 0.13%, buoyed by gains in semiconductor makers and cloud‑software providers that outperformed earnings expectations. The rally helped offset a broader risk‑off sentiment in the market.

Dow Jones Industrial Average (-0.38%)

The Dow Jones Industrial Average slipped to 47,560.29, a 0.38% decline, as heavyweights in the industrial and consumer‑discretionary sectors posted earnings misses and warned of softer demand. The broader market sell‑off was amplified by a rise in the U.S. dollar, which pressured export‑oriented companies.

Top Movers

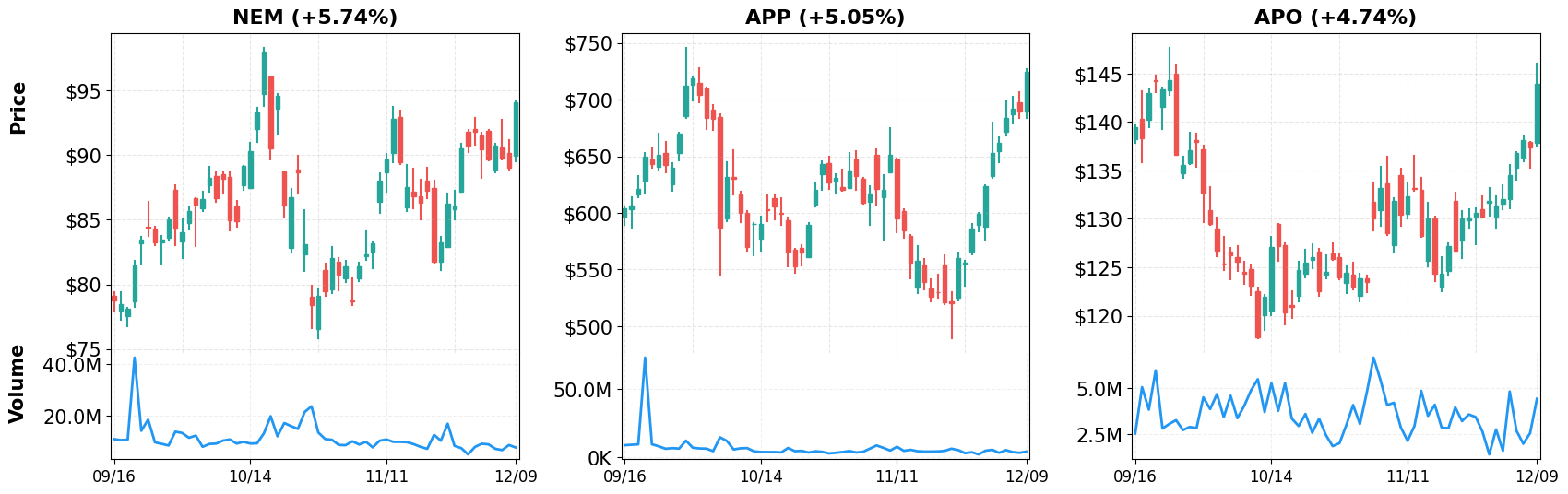

Top Gainers

- NEM (+5.74%)

- APP (+5.05%)

- APO (+4.74%)

Top Losers

- AZO (-7.28%)

- CPB (-5.23%)

- JPM (-4.65%)

Magnificent 7

Overview

Performance Comparison: Magnificent 7 vs Major Indices

- YTD Performance:

- S&P 500 (VOO): +17.96%

- NASDAQ-100 (QQQ): +22.97%

- Magnificent 7 (MAGS): +23.98%

M7 Total Market Capitalization

- YTD Market Cap Change:

- $16.05T (1/1) → $19.44T (current), +21.12%

1. AAPL

Price: $277.18 (-0.26%)

- Apple (AAPL) Lands $330 Target as CLSA Turns More Bullish on iPhone Momentum

- Apple Stock Gets Three Price-Target Hikes. Here’s Why.

- OpenAI’s New AI Gadget Might Be an iPhone Disruptor. But Apple Won’t Be Standing Still

2. AMZN

Price: $227.92 (+0.45%)

- MSFT: Microsoft Unveils $23 Billion AI Investment Plan to Challenge Amazon, Google

- Oracle set to report earnings as Wall Street looks for cracks in the AI bubble

- Trump approves Nvidia H200 chips for sale to China

3. GOOGL

Price: $317.08 (+1.07%)

- Alphabet Stock Jumped 13.9% In November. What’s Next?

- Tesla vs. Alphabet: Which Is the Better AI Stock for 2026?

- Oracle set to report earnings as Wall Street looks for cracks in the AI bubble

4. META

Price: $656.96 (-1.48%)

- Meta’s Heavy AI Spending Justified Says Pro. Is He Right?

- Ray-Ban Meta Glasses Gain Momentum but Face Privacy and Competition Challenges

- Apple’s $4 Trillion Comeback: Why It’s Now Beating Nvidia, Microsoft, and Meta at Their Own Game

5. MSFT

Price: $492.02 (+0.20%)

- Microsoft Outlook Brighter With Azure, OpenAI Deal In Focus. Is The Software Giant A Buy Now?

- What Trump’s Nvidia China sales approval means for the Mag 7

- Trump approves Nvidia H200 chips for sale to China

6. NVDA

Price: $184.97 (-0.31%)

- Trump green-lights Nvidia selling H200 chips to China

- Stock market today: Dow, S&P 500, Nasdaq fall as Netflix skids on deal drama, Nvidia rises

- Trump’s Reprieve for Nvidia’s H200 Spurred by Huawei’s AI Gains

7. TSLA

Price: $445.26 (+1.29%)

- Tesla unsupervised FSD milestone ‘very close,’ Piper Sandler says

- Tesla stock drops as new Morgan Stanley analyst downgrades shares, citing valuation

- Tesla downgraded at Morgan Stanley

Disclaimer: This market briefing is for informational and educational purposes only and should not be considered investment advice. The information presented is based on publicly available data and represents the author’s analysis as of December 09, 2025. Stock prices are volatile and past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making investment decisions. The author may or may not hold positions in the securities discussed.

Leave a comment