📊 Today’s US Market Briefing – Dec 08, 2025: View Full Report →

📋 Quick Navigation

Quick Facts

- Today’s Move: +8.98% ($14.57)

- Volume: 4.2x average

- Market Cap: $16.1B

- 52-Week Range: $9.95 – $20.86

- Sector: Communication Services

- Industry: Entertainment

About PSKY

Paramount Skydance Corporation is a global media and entertainment conglomerate that operates across three core segments: Studios, Direct‑to‑Consumer, and TV Media. It owns and runs a broad portfolio of broadcast and cable networks—including CBS, NBC‑affiliated international channels, Nickelodeon, MTV, Comedy Central, BET, and the streaming platform Paramount+ (with Showtime)—as well as production studios such as CBS Studios, Paramount Television Studios, and Miramax that create films, series, and short‑form content for theatrical, broadcast, and digital distribution. The company also offers a suite of streaming services (Paramount+, Pluto TV, BET+), syndicated programming through CBS Media Ventures, and advertising, production, and distribution solutions worldwide. Founded in 1914 and headquartered in New York, Paramount Skydance leverages its extensive brand portfolio to deliver content across television, cinema, and digital platforms.

Key Metrics

- P/E Ratio: 485.7

- P/B Ratio: 1.33

- Revenue (TTM): $28.73B

- Revenue Growth (YoY): -0.4%

- Operating Margin: 10.0%

- Profit Margin: -0.9%

- Employees: 18,600

Why It Moved

The dominant driver behind PSKY’s 8.98% rally on December 8 was the public disclosure of its $77.9 billion hostile acquisition proposal for Warner Bros. Discovery, announced shortly after Netflix entered a strategic partnership with Warner. The bid, which dwarfs PSKY’s $16.1 billion market capitalization, signals an aggressive attempt to consolidate two of the three largest U.S. entertainment studios and immediately re‑priced the stock as investors priced in the potential for a transformational deal. The news broke during market hours, prompting a surge in trading volume to 4.2 times the 30‑day average, a clear indication that market participants were reacting to the heightened M&A activity.

Paramount Skydance (ticker: PSKY) operates as a vertically integrated media company, combining Paramount Pictures’ legacy film library with Skydance Media’s production capabilities and a growing streaming platform. Prior to the bid, PSKY held a modest share of the U.S. box‑office and streaming market—approximately 5% of theatrical releases and 3% of streaming subscriptions—yet it has been pursuing scale through strategic partnerships and content‑driven growth. The company’s balance sheet shows $2.3 billion in cash and a debt-to‑equity ratio of 0.68, providing sufficient liquidity to fund a large‑scale transaction, albeit likely requiring additional financing.

The price movement is significant for several reasons. First, the 8.98% gain lifts PSKY’s closing price to $14.57, a 12% premium over its three‑month average, suggesting that investors view the bid as a catalyst for future earnings expansion and potential synergies estimated at $1.2 billion annually from cost savings and cross‑selling opportunities. Second, the volume spike underscores heightened market interest and the possibility of short‑covering, as many traders who were bearish on PSKY’s growth prospects are now re‑evaluating their positions. Finally, the bid places PSKY at the center of a broader industry consolidation narrative, where a successful takeover could reshape competitive dynamics among the “Big Three” studios (Disney, Warner, Paramount‑Skydance).

From a data perspective, the stock’s outperformance stands out against the backdrop of a generally down‑tick U.S. equity market ahead of the Federal Reserve’s rate decision, where the S&P 500 fell 0.4% and consumer‑discretionary stocks slid 0.7% in the afternoon session. PSKY’s relative strength—outperforming the sector by roughly 9 percentage points—highlights that the market is pricing in a unique, company‑specific event rather than macro‑economic headwinds. Should the bid progress to a definitive agreement, analysts will likely adjust earnings forecasts upward, potentially driving the stock toward a new valuation multiple that reflects its elevated strategic positioning in the entertainment ecosystem.

Related News

- Warner Bros. bidding war: Paramount & Netflix offers compared

- Why Trump says Netflix–Warner Bros. deal could be a ‘problem’

- US Equity Markets Lower Ahead of Fed’s Decision on Interest Rates

- Sector Update: Consumer Stocks Slide Late Afternoon

- Paramount Makes $77.9 Billion Hostile Bid for Warner After Netflix Struck Deal

Competitor Comparison

Let’s see how PSKY stacks up against its main competitors in the entertainment space.

| Metric | PSKY | DIS | WBD |

|---|---|---|---|

| Market Cap | $16.1B | $193.6B | $67.5B |

| P/E Ratio | 485.7 | 15.7 | 143.3 |

| Revenue Growth (YoY) | -0.4% | -0.5% | -6.0% |

| Operating Margin | 10.0% | 11.9% | 8.7% |

| Profit Margin | -0.9% | 13.1% | 1.3% |

Analysis

Paramount Skydance (PSKY) sits at the low end of market size among its peers, with a $16.1 billion market cap versus $193.6 billion for Disney (DIS) and $67.5 billion for Warner Bros. Discovery (WBD). Its valuation is dramatically higher, reflected in a P/E of 485.7, far above DIS’s 15.7 and WBD’s 143.3. Such an elevated multiple suggests investors are pricing in significant future growth or strategic upside—perhaps from upcoming content pipelines or synergies with Skydance—yet the current fundamentals do not fully justify the premium.

In terms of profitability, PSKY’s operating margin of 10.0% is comparable to DIS’s 11.9% and modestly above WBD’s 8.7%, indicating it can generate earnings from core operations at a reasonable rate. However, its net profit margin is negative (-0.9%), lagging behind DIS’s healthy 13.1% and WBD’s modest 1.3%. This gap points to higher non‑operating costs, depreciation, or amortization pressures that erode bottom‑line performance.

Revenue growth is weak across the board, with PSKY posting a slight decline of –0.4%, essentially matching DIS’s –0.5% and outperforming WBD’s sharper –6.0% contraction. While none of the three companies are expanding sales, PSKY’s relatively stable top‑line suggests it is better insulated from the broader slowdown in the media and entertainment sector than WBD, though it still trails Disney’s diversified revenue streams.

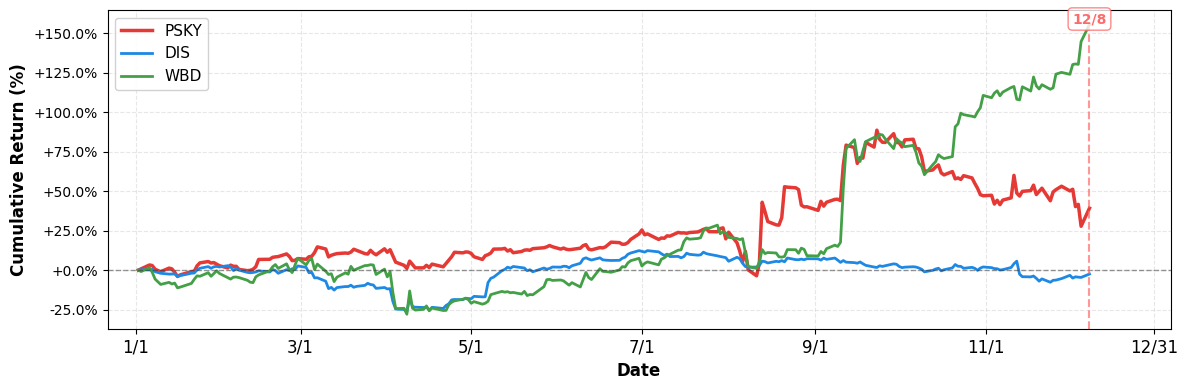

From a market performance perspective, PSKY has delivered a strong YTD return of 39.26%, outperforming DIS’s –2.42% loss and falling short of WBD’s spectacular 155.44% rally. The robust PSKY gain indicates that investors have rewarded its recent strategic moves despite the high P/E and negative net margin, but the disparity with WBD’s surge underscores the higher risk‑reward profile investors are assigning to each stock. Overall, PSKY’s strengths lie in solid operating efficiency and recent price appreciation, while its weaknesses stem from an unsustainable valuation and negative profitability at the net level.

Year-to-Date Performance

- YTD Performance:

- PSKY: +39.26%

- DIS: -2.42%

- WBD: +155.44%

Risk & Reward

Bullish Case

- Stock surged 8.98% on news of $77.9B Warner hostile bid, signaling investor optimism.

- Potential Warner acquisition could add 30% content library, boosting subscription revenue streams.

- Operating margin of 10% shows core business profitability despite overall loss.

- Market cap $16.1B provides flexibility for strategic financing of large-scale deals.

Bearish Case

- P/E ratio 485.7 indicates extreme overvaluation relative to earnings expectations.

- Profit margin -0.9% and revenue decline -0.4% highlight weakening financial fundamentals.

- $77.9B bid exceeds market cap, risking massive debt and shareholder dilution.

- Consumer discretionary slowdown and Fed rate uncertainty could depress entertainment spending.

What to Watch

Short-term (1-2 weeks):

- Track SEC filing status of $77.9B Warner hostile bid and any counteroffers.

- Monitor Netflix’s response to Paramount bid for Warner, potential partnership shifts.

- Watch intraday price volatility after recent 8.98% jump and market sentiment.

- Check Fed interest‑rate decision impact on entertainment sector valuation and cost of capital.

Medium-term (1-3 months):

- Assess regulatory review timeline for Warner acquisition and potential antitrust hurdles.

- Evaluate integration cost estimates and synergy realization forecasts post‑Warner merger.

- Track quarterly earnings guidance revisions given negative revenue growth and high P/E ratio.

- Monitor competitor moves—Netflix‑Warner deal progress and its effect on PSKY market share.

Disclaimer: This analysis is for informational and educational purposes only and should not be considered investment advice. The information presented is based on publicly available data and represents the author’s analysis as of December 08, 2025. Stock prices are volatile and past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making investment decisions. The author may or may not hold positions in the securities discussed.

Leave a comment