[Watch today’s 60-second video summary here: (Feature coming soon)]

📋 Table of Contents

Market Overview

U.S. equities posted a broadly bullish session on November 25, 2025 (Tuesday), with all three major indices closing higher. The rally was driven by stronger-than-expected corporate earnings and a firm labor market, which bolstered risk appetite. Volume was above average, indicating robust participation across sectors.

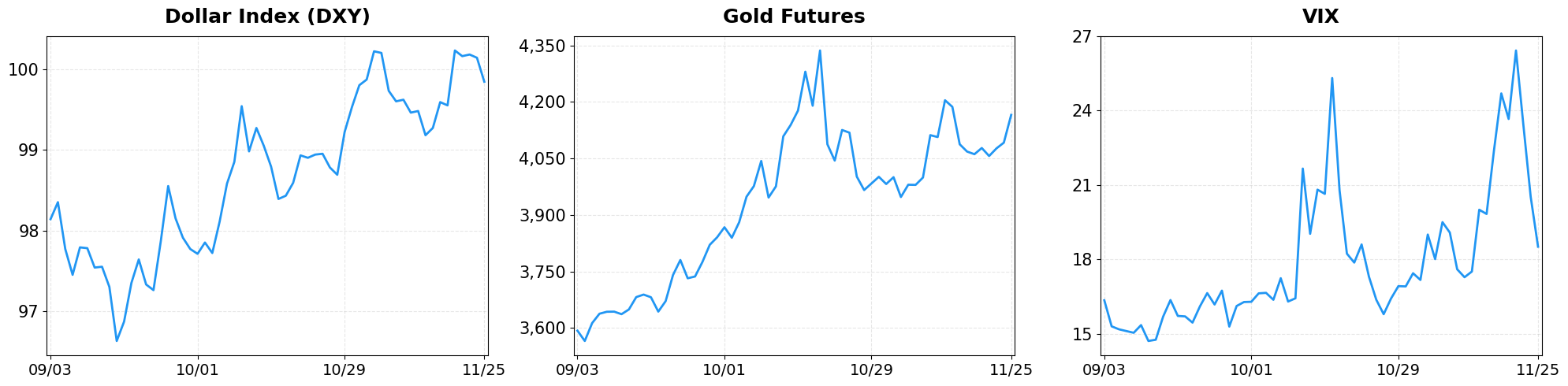

- Dollar Index moved from 100.14 to 99.84 (-0.30%).

- Gold Futures moved from 4091.90 to 4165.50 (+1.80%).

- VIX moved from 20.52 to 18.51 (-9.80%).

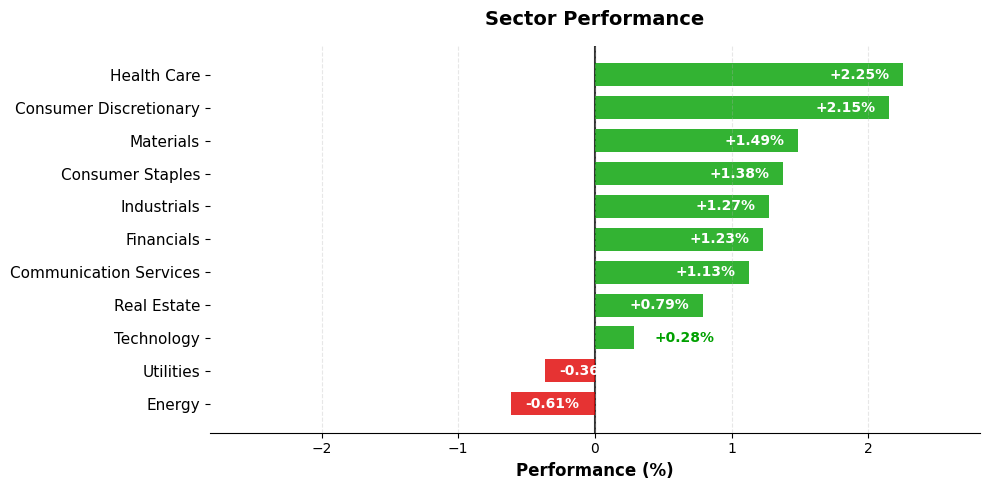

Today’s sector performance shows the following movements:

Market News Highlights

The broad U.S. equity market extended its rally for a third consecutive session on Tuesday, driven by growing expectations of a Federal Reserve rate cut. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all posted gains, buoyed by strong earnings momentum from mega‑cap tech names. Apple and Alphabet each posted record‑high closes, reinforcing the tech sector’s leadership in the rally. Meanwhile, consumer confidence data showed resilience even as retail sales softened, a combination that has kept market participants optimistic about a near‑term easing of monetary policy.

On the corporate front, Symbotic’s shares surged after the company released an upbeat Q1 outlook, highlighting accelerated automation demand in logistics. In parallel, SanDisk’s upcoming inclusion in the S&P 500 added a fresh component to the index, which may attract additional passive‑fund inflows. The broader tech rally was complemented by modest gains in precious metals, with gold and silver prices holding steady, while cryptocurrency markets faced pressure; Bitcoin slipped below the $88,000 mark, pulling down the broader crypto index.

Overall, the confluence of strong tech earnings, positive corporate guidance, and persistent Fed‑cut speculation has reinforced risk‑on sentiment. However, the weakness in retail sales and the pullback in crypto suggest that investors remain cautious about the durability of the rally, keeping a watchful eye on forthcoming economic releases.

Referenced Articles

- Stock market today: Dow, S&P 500, Nasdaq rally for 3rd day as Fed rate cut hopes grow, Apple and Alphabet notch records

- Symbotic stock surges on Q1 outlook, Sandisk to join S&P 500

- Tech rally, gold and silver prices, bitcoin: Market Takeaways

- Top Cryptocurrencies Fall; Bitcoin Drops Below $88,000

- US Equity Indexes Rise as Consumer Confidence, Retail Sales Weakness Keep Fed Rate-Cut Bets Elevated

Index Performance

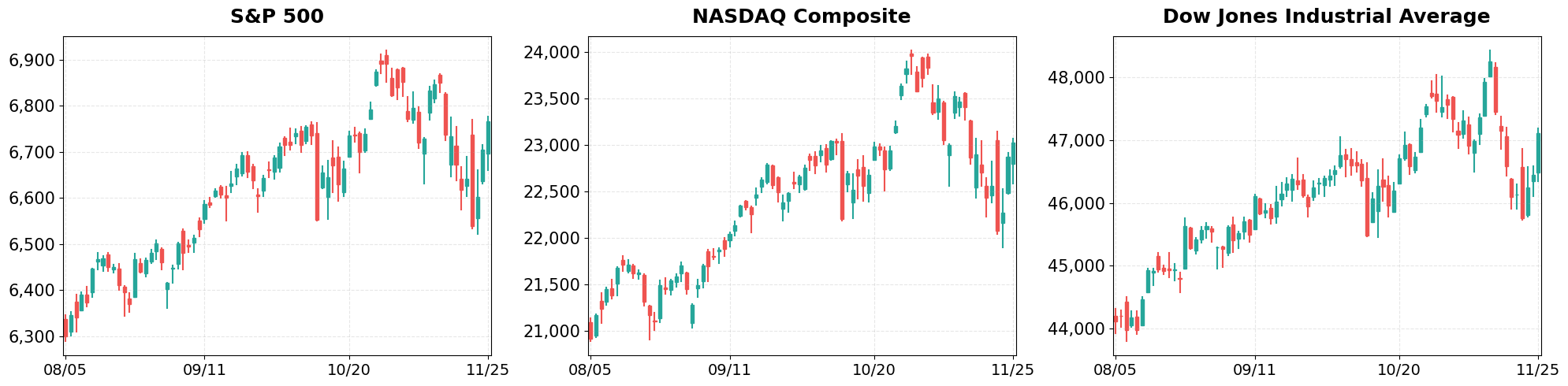

S&P 500 (+0.91%)

The S&P 500 climbed to 6,765.88, up 0.91% or 60.76 points, as technology and consumer discretionary stocks led the advance. The gain narrowed the gap to the year‑to‑date high, suggesting momentum remains intact. The sector rotation toward cyclical names also contributed, as investors priced in expectations of higher consumer spending later in the year.

NASDAQ Composite (+0.67%)

The Nasdaq Composite rose to 23,025.59, gaining 0.67% or 153.58 points, supported by continued strength in semiconductor makers and cloud‑service providers. The broader tech rally helped offset modest weakness in growth‑oriented names. Moreover, the recent easing of regulatory concerns around data privacy gave additional confidence to the sector.

Dow Jones Industrial Average (+1.43%)

The Dow Jones Industrial Average surged to 47,112.45, up 1.43% or 664.18 points, propelled by industrials and financials that posted earnings beats. The sizable jump lifted the Dow back above the 47,000 threshold, reinforcing bullish sentiment. Additionally, the upward revision of GDP growth forecasts by economists further buoyed the industrial and financial components.

Top Movers

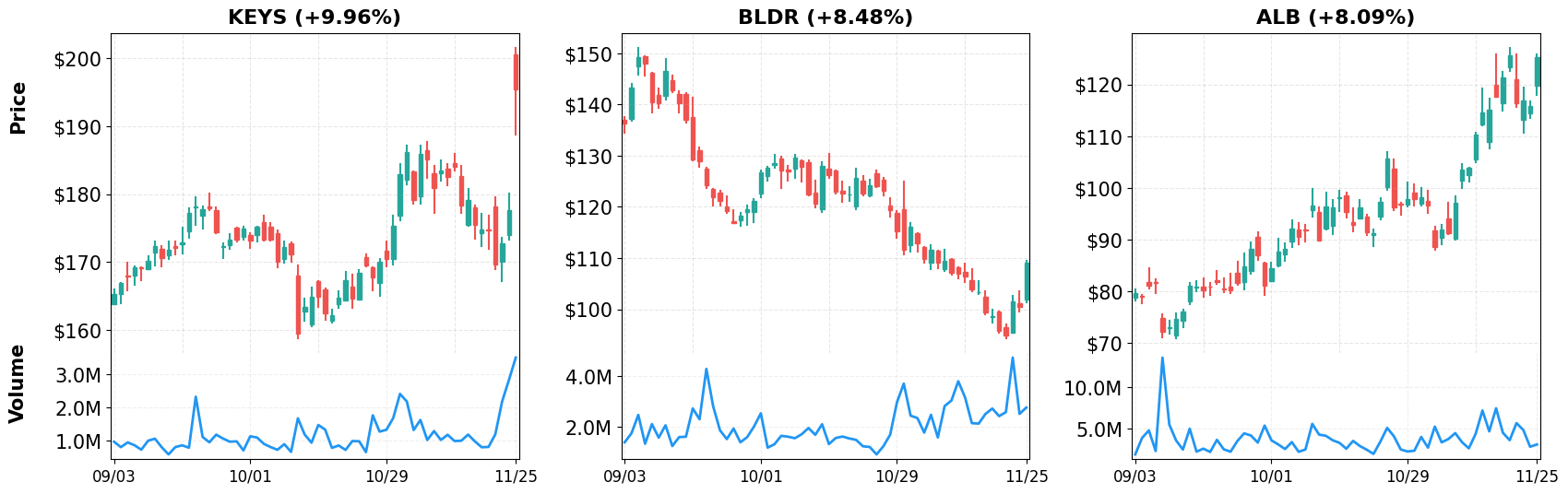

Top Gainers

- KEYS (+9.96%)

- BLDR (+8.48%)

- ALB (+8.09%)

Top Losers

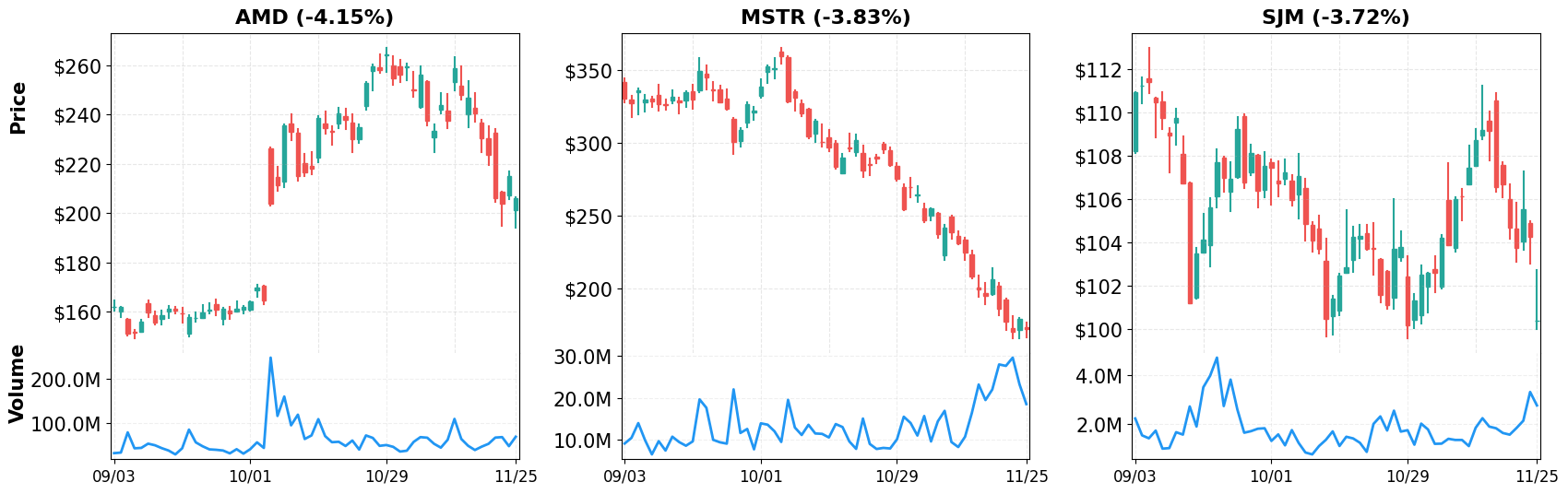

- AMD (-4.15%)

- MSTR (-3.83%)

- SJM (-3.72%)

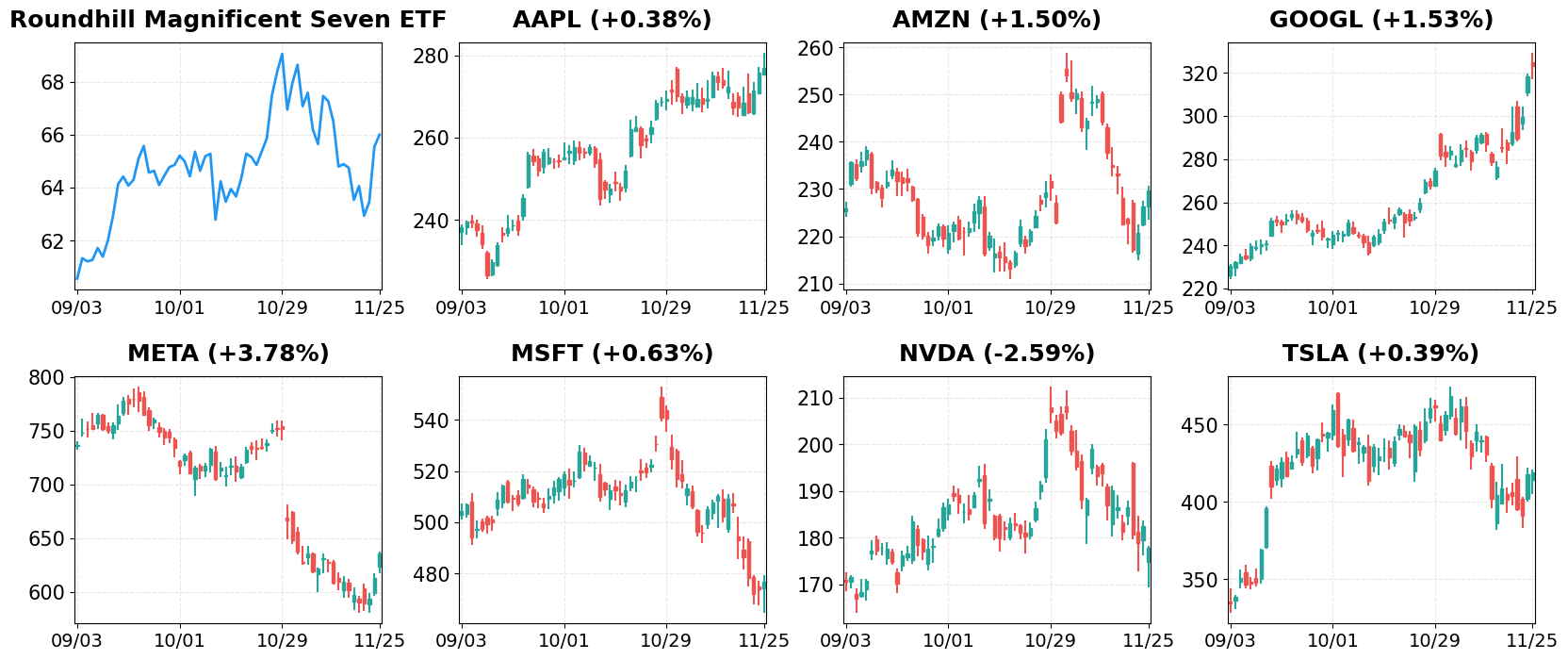

Magnificent 7

Overview

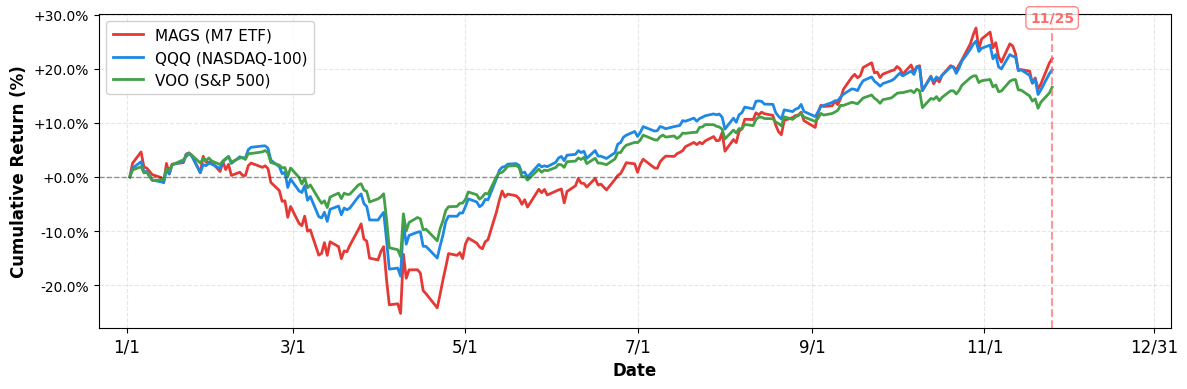

Performance Comparison: Magnificent 7 vs Major Indices

- YTD Performance:

- S&P 500 (VOO): +16.56%

- NASDAQ-100 (QQQ): +19.79%

- Magnificent 7 (MAGS): +21.87%

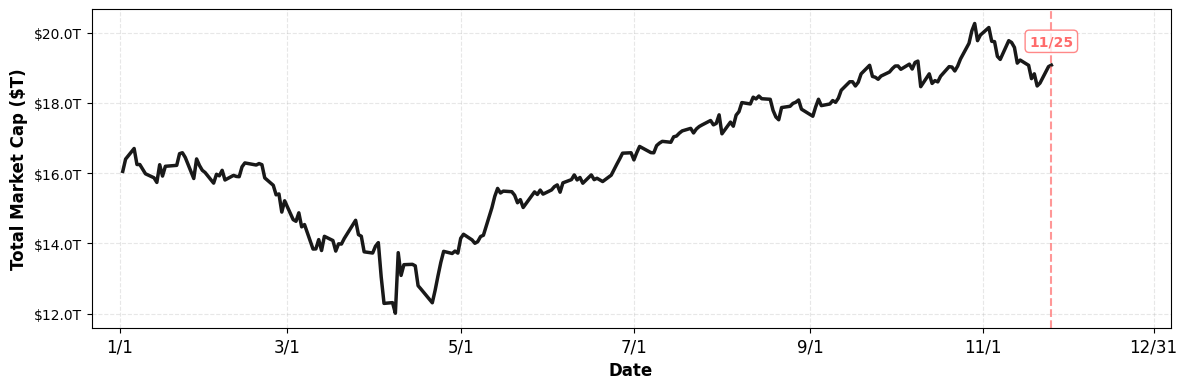

M7 Total Market Capitalization

- YTD Market Cap Change:

- $16.05T (1/1) → $19.08T (current), +18.88%

1. AAPL

Price: $276.97 (+0.38%)

- Stock market today: Dow, S&P 500, Nasdaq rally for 3rd day as Fed rate cut hopes grow, Apple and Alphabet notch records

- Apple reportedly cuts sales jobs

- Apple Cuts Jobs Across Its Sales Organization

2. AMZN

Price: $229.67 (+1.50%)

- Why Google’s Challenge To Nvidia Is ‘Intriguing’ For Amazon’s AI Chip Push

- How Amazon Relay turns peak season volume into real opportunity

- MercadoLibre Just Got Ambushed: Amazon, Temu, and Shopee Are Crashing Its Holiday Party

3. GOOGL

Price: $323.44 (+1.53%)

- Stock market today: Dow, S&P 500, Nasdaq rally for 3rd day as Fed rate cut hopes grow, Apple and Alphabet notch records

- Alphabet nears $4T market cap: Could stock mirror Nvidia’s rise?

- Google TPUs vs. Nvidia GPUs: The differences between these 2 chips

4. META

Price: $636.22 (+3.78%)

- Google In Talks To Offer Its AI Chips To Meta; Nvidia, AMD Fall

- Alphabet Stock Hits Record Peak After Report Meta Aims to Buy Google’s TPU Chips

- Nvidia Stock Drops on Rumored Google–Meta Chip Deal. Should Investors Be Worried?

5. MSFT

Price: $476.99 (+0.63%)

- Wedbush Highlights Microsoft and Nvidia in Year-End Tech Leaders List

- Microsoft’s (MSFT) Agent 365 and Copilot App Builder Drive Bullish Analyst Outlook

- Nvidia stock falls after report says Google, Meta in talks for multibillion-dollar AI chip deal

6. NVDA

Price: $177.82 (-2.59%)

- Alphabet nears $4T market cap: Could stock mirror Nvidia’s rise?

- Nvidia & AMD stocks fall on Meta news, Kohl’s stock skyrockets

- Google In Talks To Offer Its AI Chips To Meta; Nvidia, AMD Fall

7. TSLA

Price: $419.40 (+0.39%)

- Tesla European sales tumble nearly 50% in October

- What Musk And Tesla Are Saying About FSD With Weeks To Go Before This Big Deadline

- Wall Street Price Prediction: Tesla’s Share Price Forecast for 2025

Disclaimer: This market briefing is for informational and educational purposes only and should not be considered investment advice. The information presented is based on publicly available data and represents the author’s analysis as of November 25, 2025. Stock prices are volatile and past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making investment decisions. The author may or may not hold positions in the securities discussed.

Leave a comment